We are releasing a new set of features (at no extra cost) designed to enhance the way financial advisors manage prospect/client risk—Kwanti’s Risk Profiling Tool. This powerful addition enables advisors to send risk profiling questionnaires, compare client risk profiles with portfolio risk scores, and generate personalized investment policy statements. Let’s take a look at the key pieces of this new enhancement:

Introducing the Concept of a “Client” in Kwanti

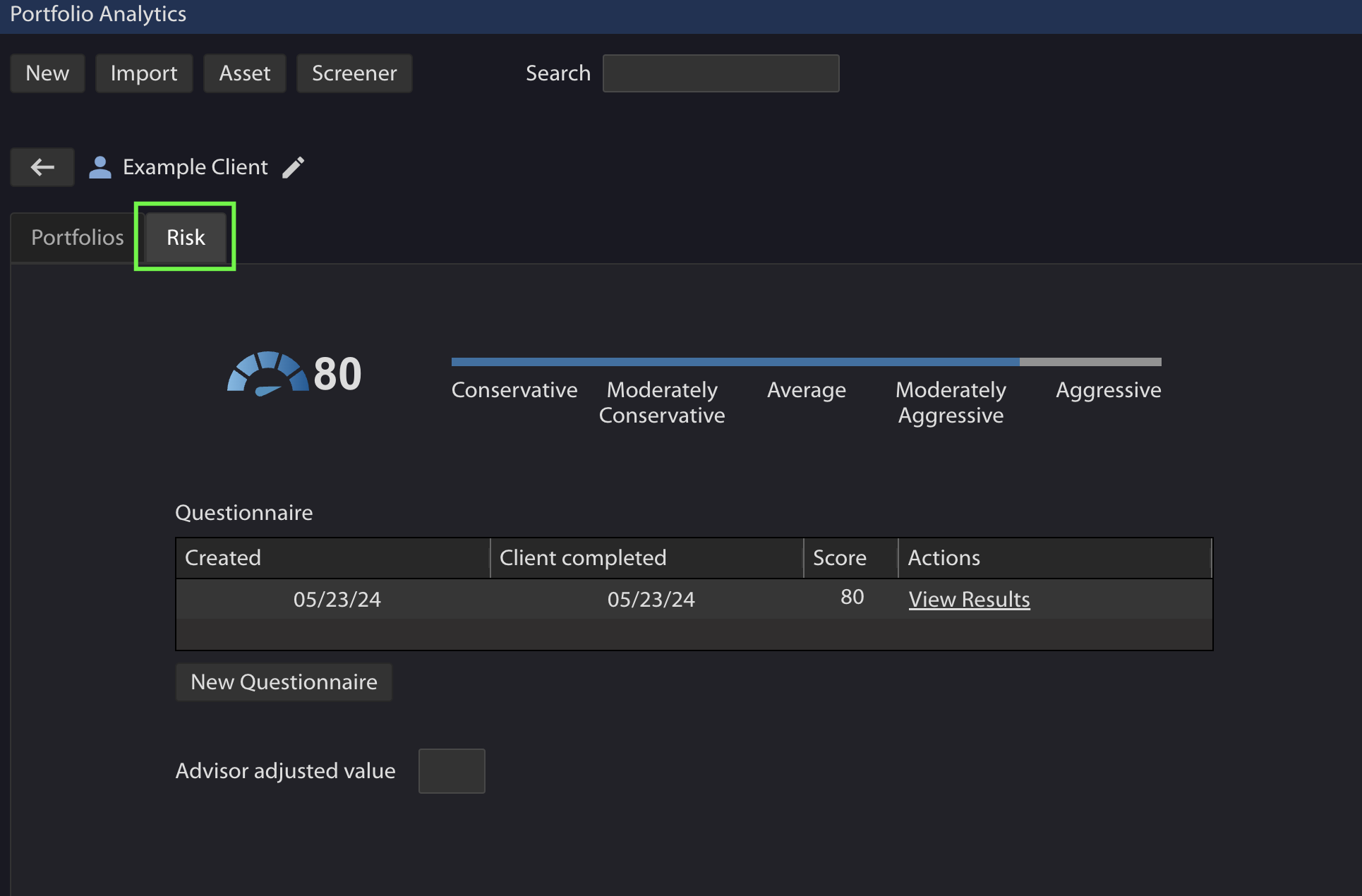

Our new Risk Profiling feature starts with introducing a dedicated Client section in Kwanti. A Client in Kwanti is designed to help advisors better organize their clients’ data, making it easy to manage everything from risk assessments to portfolio reviews. This client-centric approach allows you to associate all risk and portfolio data directly with individual prospects/clients, enhancing personalization and efficiency.

Each Client acts as a hub for managing questionnaires, portfolios, and more, ensuring that client-specific data is organized and accessible. For more detailed instructions on setting up clients, read more here.

Risk Questionnaires

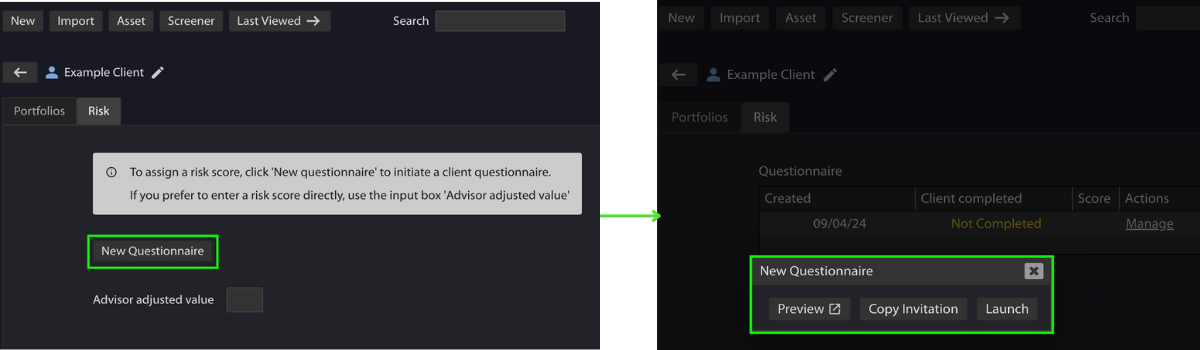

Understanding a client’s risk capacity and tolerance is crucial for tailoring investment strategies. With Kwanti’s Risk Questionnaire feature, advisors can easily send out customizable risk profiling questionnaires to prospects or existing clients. These questionnaires help gather essential insights into each client’s financial goals, risk preferences, and investment time horizon.

Once a client completes the questionnaire, their responses are stored in their profile, providing a clear picture of their risk profile. This data can then be used to align their risk profile with their current portfolio or a recommended model. Read more about sending questionnaires here.

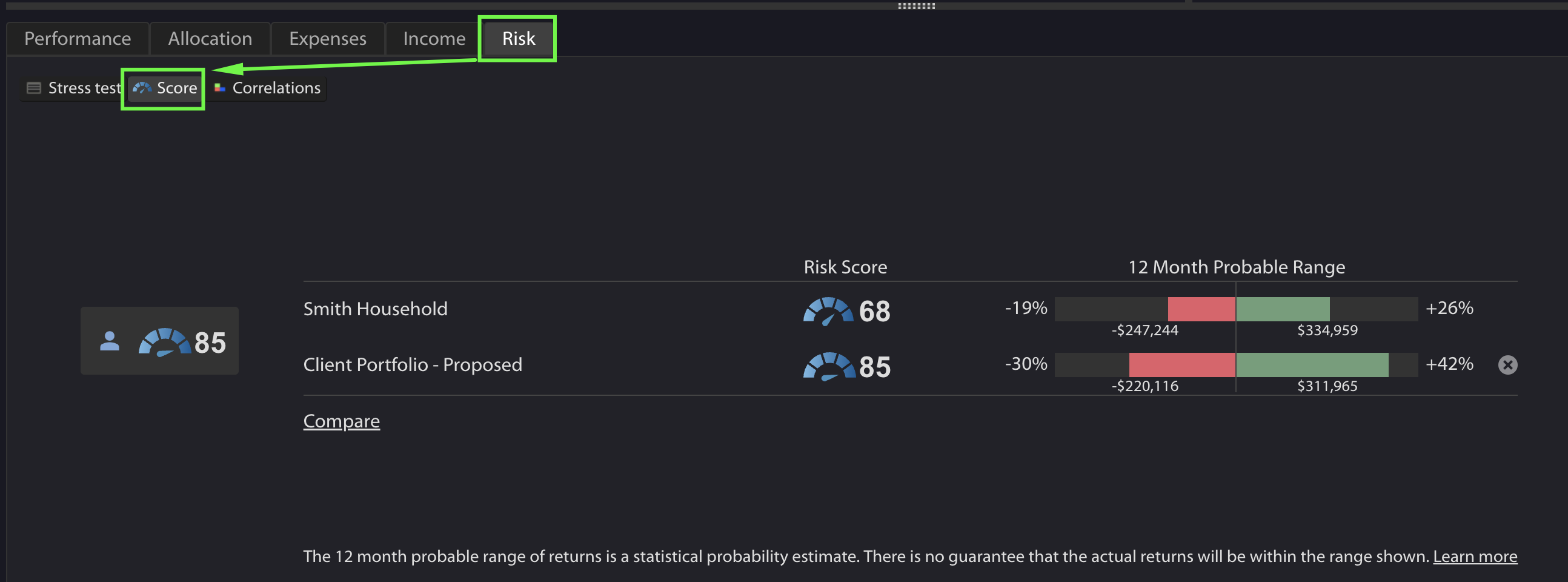

Compare Risk Scores of Portfolios and Clients

Our Risk Profiling Tool introduces a Risk Score feature that quantifies the risk of your portfolios and models. After receiving a client’s risk questionnaire results, you can easily compare their risk capacity and tolerance with the risk score of their current or proposed portfolio. This side-by-side comparison helps identify any mismatches between a client’s risk preferences and their portfolio’s actual risk, empowering advisors to make informed adjustments.

The risk score is a key metric that simplifies portfolio analysis and enables better alignment with client expectations. Learn more about Portfolio Risk Scores here.

Personalized Investment Policy Statement

Once you’ve compared a client’s risk tolerance with their portfolio, the next step is to create a detailed Investment Policy Statement (IPS). The IPS is a customized document that outlines the client’s risk preferences, recommended portfolio adjustments, and long-term investment strategy. It provides clear, actionable guidance for both the advisor and the client, ensuring transparency and alignment.

Kwanti’s Risk Profiling feature makes it easy to generate an IPS directly within the platform, offering a streamlined process to summarize recommendations and facilitate client conversations.

With these new enhancements, Kwanti continues to prioritize usability, making risk profiling straightforward and efficient. Like every other feature in Kwanti, the Risk Profiling Tool is designed with the advisor’s workflow in mind, helping you seamlessly integrate client risk assessments, portfolio comparisons, and personalized recommendations into your practice. We’re committed to providing tools that help you serve your clients effectively and with ease.