What techniques do you use in your sales process to prove to a prospective client that you’re the right advisor for them?

You may walk them through your financial planning process, your investment philosophy, and show them your model portfolios if you have them.

All of those are effective and important considerations to discuss before you bring on a new client, but there’s another process you should implement, especially if you’re talking to someone who already works with an advisor.

Using portfolio analysis to compare your proposed portfolio against the portfolio a client is currently invested in can put you over the top and demonstrate with clarity how you’ll manage their assets better than their current setup.

Here’s how to use Kwanti to compare portfolio analytics and easily demonstrate your value as an advisor.

Portfolio to Portfolio Analysis

There is much more to advisor value than portfolio performance. Giving advice about how to approach large purchases, manage an everyday budget, and plan for future financial needs are all intrinsic to the services advisors offer.

But there’s perhaps no more straightforward way to show clients that they should be invested differently than to show them a side-by-side comparison of their current portfolio with one you would be managing instead.

In Kwanti, you do these comparisons easily. Simply enter a prospective client’s portfolio manually, or import it via spreadsheet.

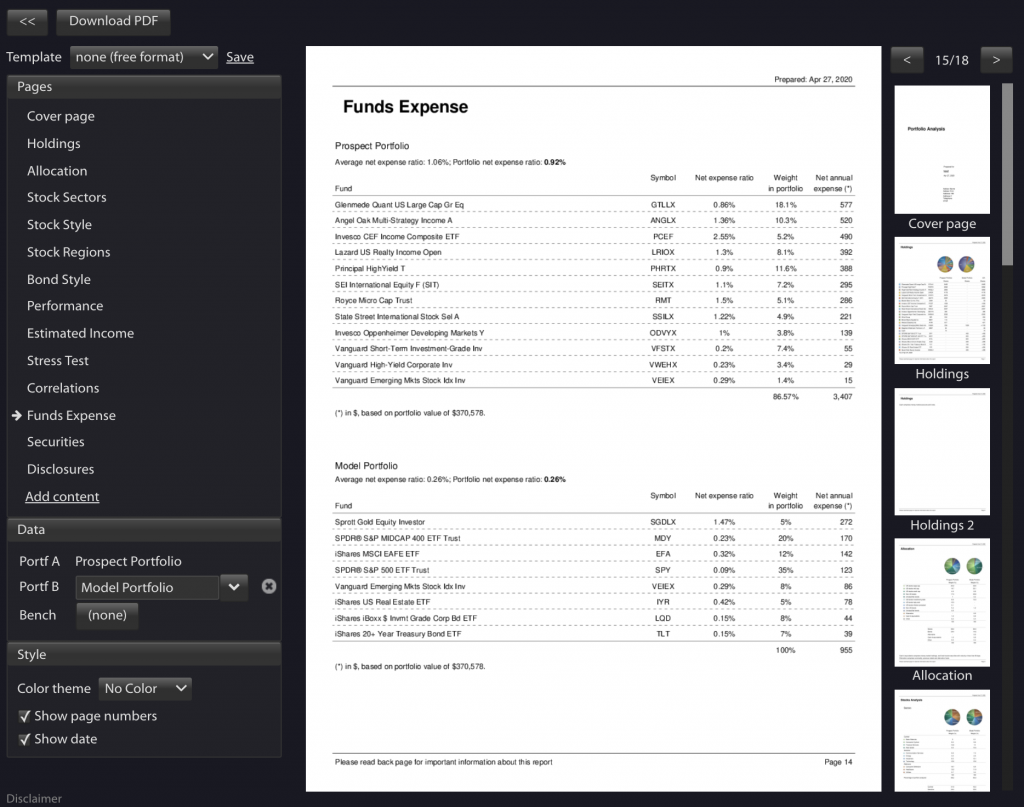

You can then select the proposed/model portfolio you would invest them in if they become a client. You’ll find a Compare button on each tab so you can easily look at differences in performance, allocation, expenses, income, asset correlation, and risk.

When you’re competing with another advisor for business, it can be a persuasive argument to show a client how much money you can save them by placing them in a portfolio with lower fund fees, or a higher income-generating portfolio. Kwanti’s PDF generator can quickly create and present a comprehensive and beautifully formatted proposal.

And when you put the comparison into a simple visual, your argument becomes that much stronger.

Portfolio Stress Testing

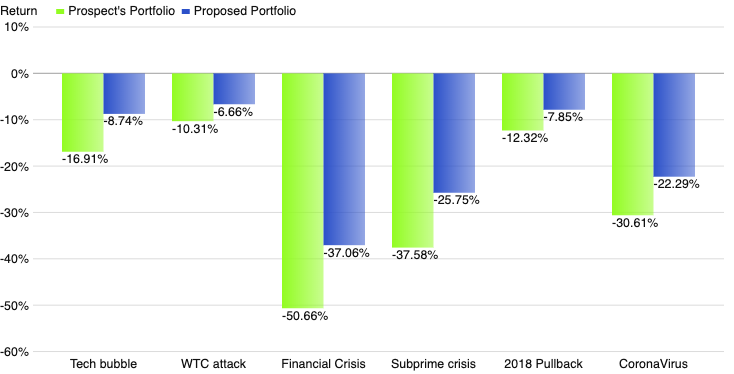

How much risk a client can handle is an important factor in any portfolio construction conversation, and you can make those hypothetical conversations grounded in reality by using stress tests.

A stress test is a comparison that shows how a portfolio, as it is currently constructed, would have performed during historical periods of high volatility.

You can access a list of pre-created stress tests in Kwanti on the Risk tab. Our list of ready-to-go stress tests includes:

- Asian crisis (1997)

- Russia/LTCM (1998)

- Tech bubble (2000-2001)

- China slowdown (2015)

- World Trade Center attack

- Subprime crisis

- Debt ceiling crisis

- 2018 Q4 selloff

- CoronaVirus (as this is ongoing, we are constantly updating this stress test with live data)

You can also add your own scenarios.

Stress testing goes beyond a portfolio-to-portfolio comparison by putting each into historical context. The conversation with your prospect then becomes not simply about their current situation, but how they may have been in a better position today if they had been working with you in the past, as well.

While nothing about the future is guaranteed, that can be a powerfully persuasive and emotional argument to make for the value you’ll bring to them over time.

The Importance of Portfolio Analysis in Your Sales Process

Financial advice can often be seen as a subjective process or a soft skill.

Incorporating more objective portfolio analysis into your sales process not only grounds your prospect’s experience in real events, it also demonstrates your true expertise and shows, in real dollars, the benefits you can bring to the relationship.

When you’ve got Kwanti by your side, rich visuals and detailed portfolio comparisons are always only a click away.

Ready to try Kwanti? Click here to start a free trial and see how our integrations can make your days more productive.