Comparing prices is as American as homemade apple pie.

When people go to a physical store, they don’t just buy what they see on the shelves; they pull out a smartphone and compare the store’s price against what Amazon or a number of other online-only retailers offer.

But comparing prices of household products and comparing fees of investment products are two different realms, and most consumers are out of their element when they try to look at the fees of any of the funds they might have in their retirement portfolio.

They know they’re there…they just don’t know how to compare them and make a meaningful decision about what’s in the best interest of their long-term financial goals.

Helping your clients understand the fees they pay is an important conversation to have, but it can also easily get confusing.

Here’s what you can do to make conversations about fund fees simple.

How to Engage Clients in a Conversation About Fees

Portfolio expenses have come into clear focus as passive investing advocates have made their case for low fee funds as the best option for most investors.

The internal fees of investment funds such as mutual funds and ETFs are important to investors because these fees, which are made up of operating and management costs, can have extremely large impacts on the eventual performance of those investments.

Put simply, high fees cause a drag on portfolio return. This isn’t to say there is no place for higher fee funds in an investment strategy, but it is definitely something that needs to be understood before any fund is placed in a client’s portfolio.

As a financial advisor, you already understand this. What’s more important is understanding how to engage both prospective and current clients so they understand it as well as you do.

For many advisors who focus on passive investing, this topic is an excellent way to start the analysis of a prospect’s portfolio, because it is easily explained.

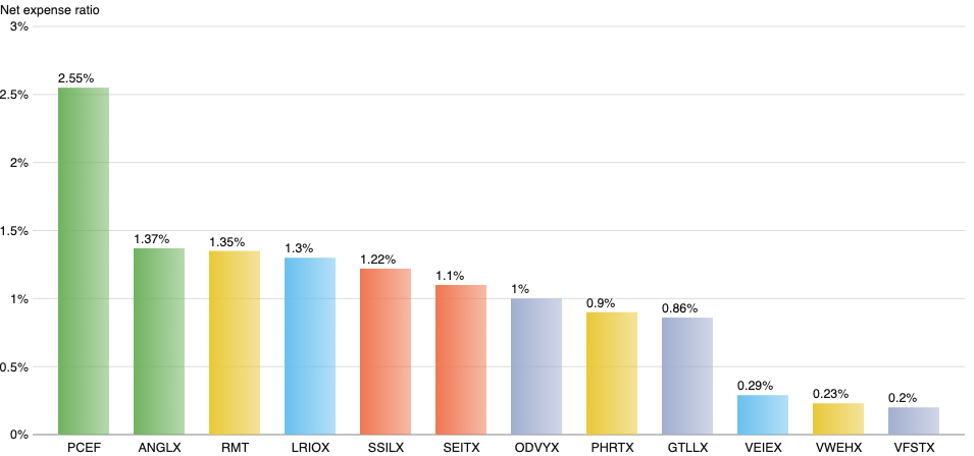

If a prospect’s portfolio contains funds with high fees, they are exposed in a fee expense chart like the one below.

The funds with high fees are prime candidates for conversation starters. You can weigh the pros and cons and discuss potential replacements as you show the prospect how you can save them money by moving them to lower fee alternatives.

The key part of your conversation needs to be visual. With so many tools available to advisors, it’s easy to demonstrate in an easy-to-understand way how much of an impact these fees can have on a portfolio’s return.

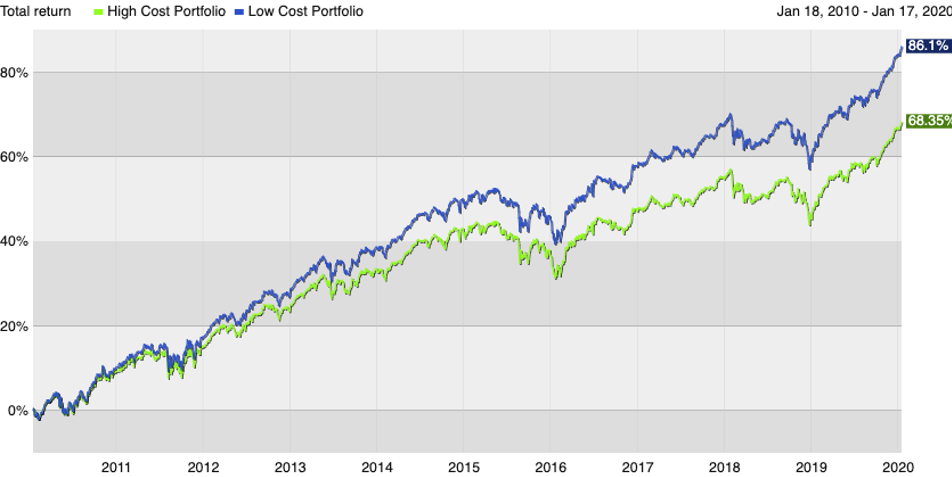

As you create proposals for prospects, including a visual that shows the effect of just a 1% difference in a portfolio’s expense ratio, in an otherwise identical portfolio, can be the difference between an investor choosing you or another advisor.

The chart below is an illustration of the difference between expense ratios in a portfolio.

As simple as it may sound, these are great ways to demonstrate the value you add as an advisor.

Understand What Expenses You’re Reporting

While it’s good that advisors have multiple tools at their disposal to view portfolio and fund expenses, that also makes it necessary to make sure you fully understand where the information you’re given comes from, and what it means.

There is not only one type of expense ratio that can be reported. For example, some tools may report the expense ratio listed on a fund’s annual report. Others may use the one listed on the fund’s prospectus.

In addition to understanding where the information you’re viewing comes from, you also need to know the answer to questions such as “Does the expense ratio for this mutual fund include expenses of the underlying funds, or is this just the reported management expense of the mutual fund I am viewing?”

Fund level detail like the expense information is important, but you should also look for a tool that shows you the high-level details as well.

For example, many tools will show you the portfolio-level expense ratio, which is a weighted average of the fund’s expenses. Another great metric you might find useful is the overall portfolio’s expenses estimate in dollars.

Often, making conversations focus on real dollars with clients can help those expenses resonate much more strongly than by simply looking at percentages. You can arrive at the dollar amount by calculating the portfolio expense ratio multiplied by the portfolio’s value. This data will go a long way in helping your clients comprehend the long-term effects of various fees.

Understanding where the information you receive comes from—regardless of what tool you are using—will help you be prepared for any questions a prospective or current client may ask you about their portfolio’s fund fees.

There is no perfect way to build a portfolio and every client’s needs are different, but it is vital that you have all the information necessary to make the best decisions possible at your disposal. Portfolio expenses are always part of the information you, and your clients, should understand when discussing their investing goals and expectations.

Already using Kwanti? Log in now to access these charts and many more to assist you in keeping your clients calm and confident.

Not a Kwanti user? Click here to start your free trial immediately—no credit card required.