It’s not every year that you get to add a new Stress Test model to the list of financial crises to compare portfolios against, but 2020 was that year.

While 2020 might have been a year to forget for many, the economic downturn will be a moment that advisors will want to remember from a risk assessment and portfolio stress testing standpoint.

Creating portfolios that are built with a strong awareness of risk and the downside potential of investments is one of the most important jobs of an advisor—and it’s one that advisors can easily complete with Kwanti.

In today’s blog, we’ll share with you all the ways you can assess risk and stress test portfolios in the app.

Let’s get started.

How to Assess Asset-Level Risk in Kwanti

We’ll start with showing you to quickly look at the risk level each holding presents in a given portfolio.

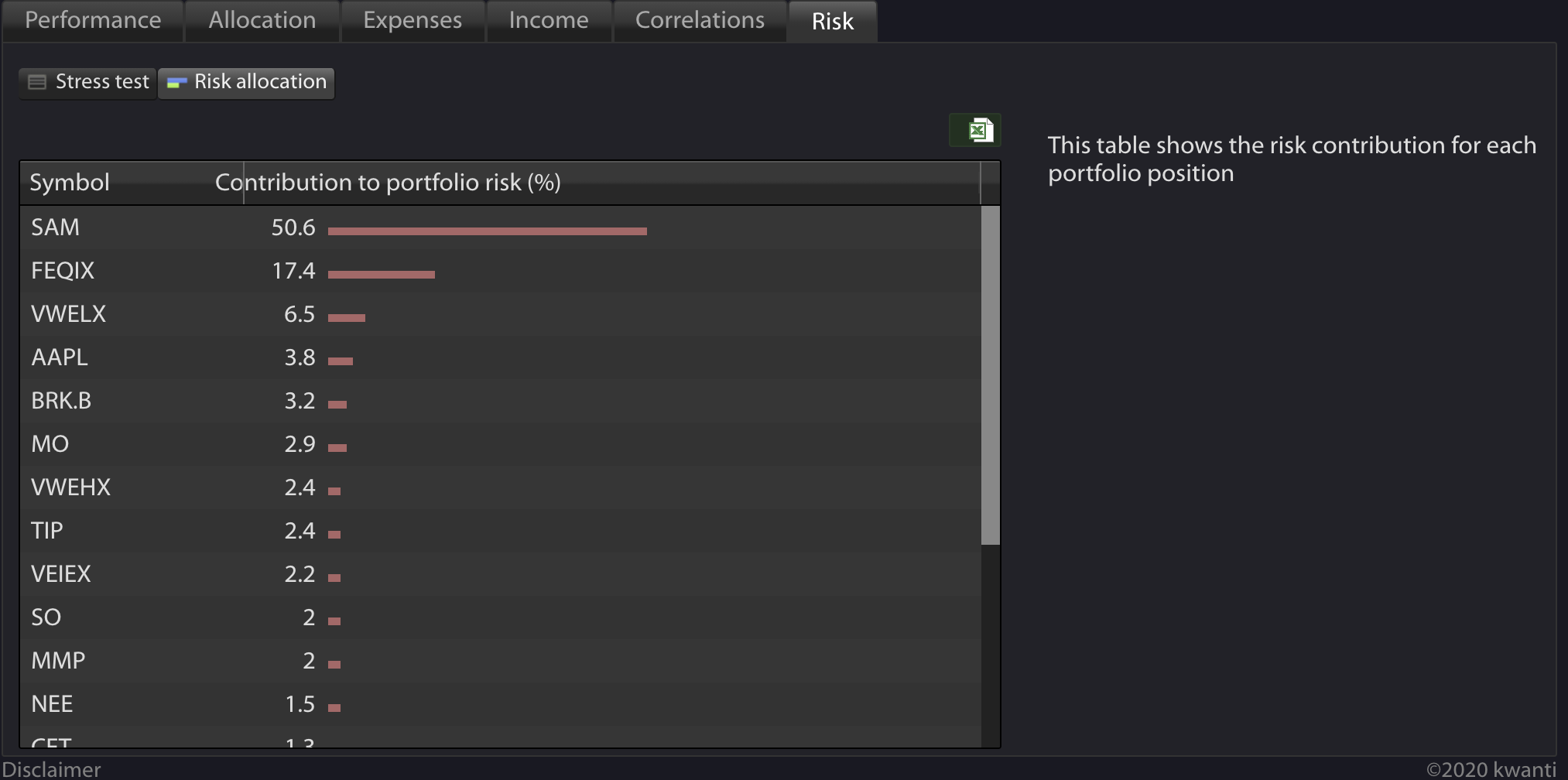

You can access risk analytics by selecting a portfolio and navigating to the Risk tab.

On this tab, you can view Risk Allocation by individual holdings, or assess a portfolio with Stress Tests.

When selecting Risk Allocation, you’ll see holdings listed in descending order, with the highest-risk asset listed first in terms of the percentage of risk it holds in the total portfolio.

From here, you can quickly gain additional insights to understand why each holding presents the amount of risk that it does.

In our example image, SAM (The Boston Beer Company) contributes 50% of the total portfolio risk. If we click over to view allocations and correlated holdings, it quickly becomes apparent why.

SAM is by far the heaviest-weighted holding in this example portfolio, making up almost 14% of the total assets owned. It’s also correlated at some level with 11 other assets the portfolio holds.

While Sam Adams might be relaxing to drink, it doesn’t look like it’s going to add much relaxation to an advisor or client’s life if this were a portfolio in real life.

Performing Portfolio Stress Testing to Safeguard Against the Next Downturn

While assessing risk on individual holdings is a necessary step in building a well-balanced portfolio, it’s also sometimes necessary to look at how a portfolio would perform on a larger level.

Kwanti allows you to take a step back and look at historically stressful periods in the market so you can get a better idea of how your portfolios might perform if a similar event occurs in the future.

Stress testing in Kwanti is a dynamic and flexible solution that can give you a quick snapshot of a portfolio’s performance during a number of scenarios.

By default, we offer these pre-built scenarios:

- Asian Crisis of 1997

- Russian Long-Term Capital Management Collapse of 1998

- Tech Bubble Deflation of 2000-2001

- World Trade Center Attack of 2001

- Subprime Lending Crisis of 2008-2009

- Debt Ceiling Crisis of 2011

- Chinese Economic Slowdown of 2015

- The 2020 Coronavirus Pandemic

You can also create your own custom scenarios. The creation can be done in seconds; choose a name, add a description, and set a date range to analyze the market during a particular time period.

If you want to get even deeper analysis, you can add multiple portfolios to a single simulation to compare and contrast how different allocations might impact results, or add an index to the comparison chart to gauge performance against the overall market.

Even though the 2020 COVID-19 pandemic may not repeat itself in our lifetimes, it’s likely that the markets will experience an event with similar downward trend at some point in the future.

One of the best ways to protect portfolios against crippling losses in such a situation is to perform regular stress tests to analyze their historical performance—and use that insight to make future judgements that balance their risk levels appropriately.

When you do it in Kwanti, the entire process can be completed in a matter of minutes and you can be better prepared with quantitative evidence to present to your clients that supports your investment recommendations.

In the end, it all results in better conversations and more confident clients.

Ready to try out Kwanti for yourself? Click here to start your free 30-day trial right now.