Michael Kitces has long been known in the financial advisor space for his unmatched dedication to, knowledge of, and experience in the financial services industry. Lucky for us, he and his team periodically perform independent market research and compile valuable information in The Kitces Report that helps advisors in our industry grow their businesses and better serve their clients.

The latest report, “The Technology That Independent Financial Advisors Actually Use (And Like),” released on January 31, 2022, provides an in-depth overview of all major advisor tech stack categories and how advisors rank their current solutions.

This year, Kwanti fared incredibly well in both user satisfaction and value for the money. We were also named as one the top companies to watch in Investment Data & Analytics.

But don’t just take our word for it, see for yourself.

User Satisfaction

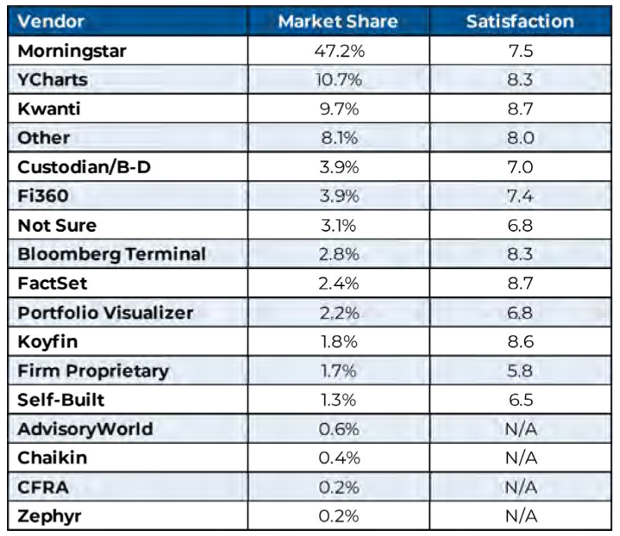

As the report mentions, Morningstar was long the leading provider of investment data and analytics for financial advisors all the way back to the 1980s and 1990s. But, the category of investment data and analytics has grown so much, with a number of new providers entering the scene, that Morningstar now represents less than half of the market share.

Adoption of these upstart investment data providers has been seen to be high in the RIA space, so data reflecting high user satisfaction and value are great news and reflect the mission we have for our tools.

We are pleased to share that Kwanti achieved one of the highest user satisfaction ratings in the category with a score of 8.7 and came in with the third-highest market share. Kwanti’s score pushed well past that of the top provider, Morningstar with 7.5, as well as the average satisfaction rating of 7.8.

Value Relative to Cost

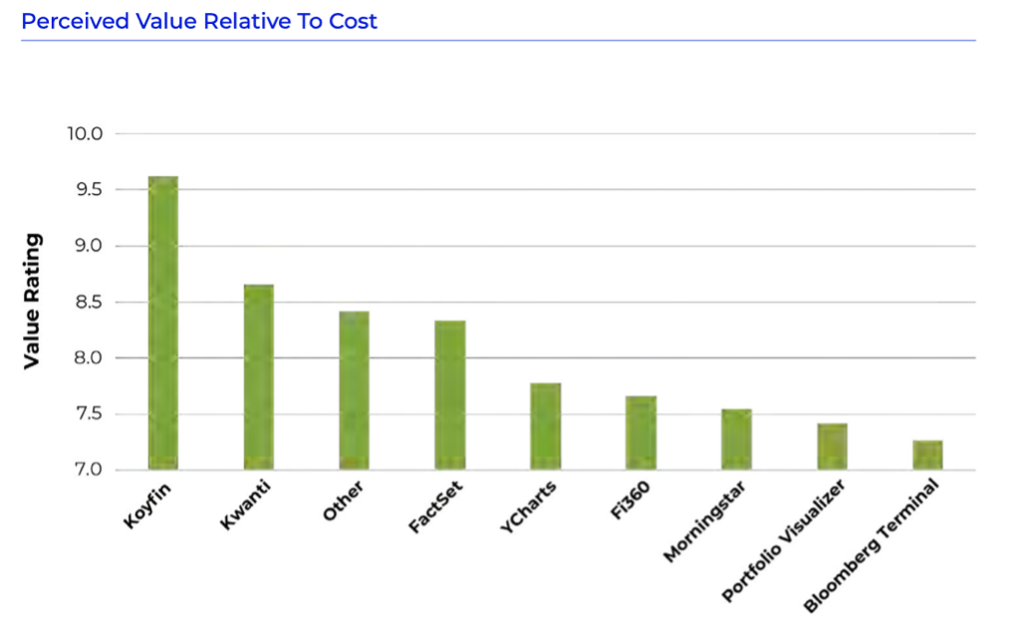

Advisors were also asked to report on the value of the tool in relation to its cost. Because investment data and analytics tools vary widely in price, it is possible that dissatisfaction could have stemmed in some cases from a high price for the tool.

Kwanti achieved the second highest rating in this category, beating out costlier options. It stands to conjecture that if the costlier options do not improve their perceived value, Kwanti and other higher-ranked options could be where more advisors move in the near future.

Optimistic about Kwanti’s Future

Kwanti is also proud to have been named in The Kitces Report as one of the Investment Data & Analytics companies to be optimistic about. Of course, this is no surprise to us. We are constantly collecting feedback from our advisor clients to improve. It is our hope that in the coming years we will be able to share our success with more advisors like those we currently work with.

As a financial advisor, you know the integral role technology plays in helping you run, manage, and grow a thriving practice. From back-office tasks to client-facing interactions, the conveniences of modern technology are invaluable. But with so many options on the market, deciding on a tech stack that works for you (and your budget) can be incredibly overwhelming.

What’s most helpful about this independent market research is just that—it’s an independent, non-bias, objective source of data from practicing financial advisors using the top technology options in the marketplace today. With our ratings improving in advisor satisfaction each year, we are confident it’s only a matter of time before more advisors start benefitting from our services.

Ready to experience why advisors are consistently pleased with Kwanti?