The typical 21st-century advisor thought leader in the wealth management business tends to disparage an investments-based approach to client relationships. If you listen to many of the trend-setting speakers, you’ve probably heard some form of the saying “If you live by performance, you’ll die by performance.”

There is, of course, wisdom in focusing your services on the things you can control (the advice you give) rather than things you have no control over (market movements).

But if we look at studies measuring investor sentiments, the driving factor behind this industry shift seems to be more motivated by what advisors want out of their client relationships rather than what clients want.

Advisors want to safeguard themselves from the appearance of fault when investments go south, so they are told to stop focusing on portfolios and start focusing on planning.

To today’s advisor, planning is king.

The only problem is that to today’s investor, investments still matter most.

What investors want to talk about

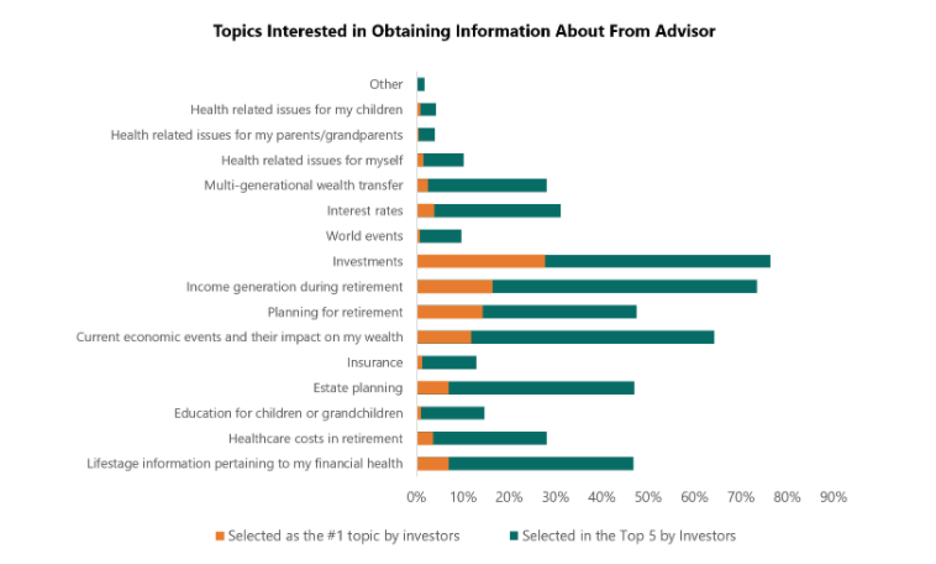

According to a new Spectrem Group study, “Communicating with Advisors and Providers,” when investors were asked what topics they most want to discuss with their advisor, the number one answer was—you guessed it—investments.

Roughly 80% of investors put investments as a top 5 topic and over 30% put it as priority #1, far ahead of the second most popular topic, income generation during retirement, which was the priority topic for 20% of investors.

Source: https://www.iris.xyz/research/what-investors-want-to-talk-about-with-their-advisor/

If investments matter so much, why do advisors shy away from talking about them?

Nearly every subject on this list is part and parcel of most advisor-client relationships.

It’s not particularly noteworthy that investors care about things like “estate planning” or “healthcare costs in retirement.” Any advisor who has been in the business long enough knows how important those considerations are for their clients, especially as they pass retirement age.

What is worth noting is that by replacing investment performance with progress toward goals, many advisors are barely skimming (or entirely avoiding) the topic a majority of investors most want to discuss.

There are numerous reasons why advisors have moved away from highlighting investment performance and taken a more high-level view to planning.

To name a few:

- As the industry moves toward a more comprehensive advice approach, investments have become one spoke on an ever-expanding wheel of services offered.

- The goals-based approach keeps meetings and the arc of planning zeroed in on what’s most important – goals – rather than getting bogged down in the details.

- Portfolio reviews eat up a lot of time in meetings, and the energy they take on both sides – for you to explain and the client to understand – can leave little space for other important topics.

- When a client’s investments have a particularly tough quarter, you could end up spending all your time trying to persuade them (with varying degrees of success) to stick to the plan.

You could go on and on in listing the benefits of a goals-based approach to planning, but the fact still remains: investors want to know what’s going on with their investments.

How to focus on investments without losing the big picture

Investors come to an advisor for their expertise—the more you’re able to show that you understand their investments, and have a plan for why they own the assets that they do, the higher the likelihood that they’ll be comfortable with the strategies you’ve chosen together.

But putting a spreadsheet or list of holdings in front of a client isn’t typically going to be an experience that leaves a positive lasting impression or captures their interest.

We believe that the advisor-client relationship should be centered on visual reporting that makes it simple for advisors to understand what’s happening in a portfolio so they can communicate it in a way that makes sense to clients too.

Kwanti’s customizable reports allow you to get into the details—like asset correlation within a portfolio—without losing sight of the big picture. Through using charts, graphs, and other visuals, you can show clients what went on with their holdings in the past, what’s happening now, and what to expect if trends continue into the future.

We’re here to support your portfolio analysis needs along every step of the advisor-client journey. From selecting a unique investment strategy from our model marketplace to creating a proposal, to managing the ongoing relationship, you can find the investment-centered data you need in Kwanti.

Try the Kwanti platform for yourself, risk free. Click here to start a free 30 day trial.