Today’s investors expect a lot from their financial advisors. From client-facing duties to back-office work, there’s no shortage of tasks for an advisor to keep up with, on any given day. So how can an advisor ensure they are giving the best possible advice to their clients while also working to grow their business? By not just using, but blending model portfolios for more efficient and flexible advice.

Model portfolios are life-savers for financial professionals. Not only do they present advisors with opportunities to simplify their investment process and potentially enhance outcomes for their clients, but they give advisors back more of their most valuable asset—time!

At Kwanti, we have launched many new models over the past year as part of our Model Marketplace. This broad menu of models is meant to address a variety of client goals and objectives. From the conservative approach to the aggressive, from an active model to a passive one, investment options are not in short supply.

Model Portfolio Objectives

When looking through models, advisors typically seek to narrow their searches by identifying portfolios suited to a client’s investment goals and risk tolerance. Some model portfolios are designed to target particular outcomes such as income generation or capital preservation. Others still are designed to fill in gaps in existing portfolios.

The Benefits of a Blended Model

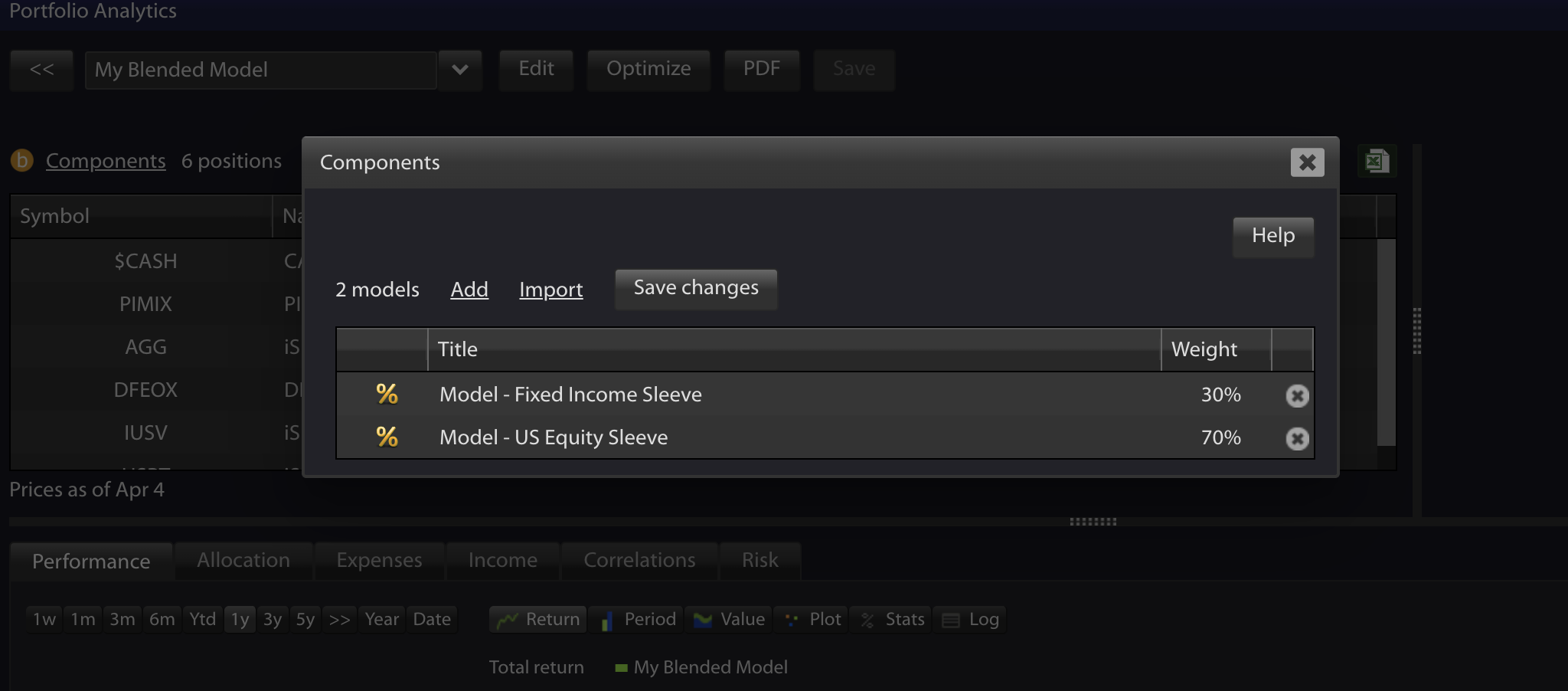

But the possibilities expand beyond even the basic models when advisors take on a blended approach. For example, an advisor maintaining an equity model and a fixed income model may blend these models in different proportions for each client, depending on their risk target.

The result is a more customized approach that can potentially help clients reach their financial goals faster and with more efficiency. Talk about added value as an advisor!

How to Approach the Blended Model

There are a number of ways to approach blending models. Advisors can choose to create:

- A blend of active and passive diversified models with similar asset allocations.

- A blend selected by asset class from more than one provider.

- A model to complement existing investment strategies (fill in the gap).

- A blend of models that target different investment objectives.

Models vary in their construction and design, but advisors can give more customized and flexible investment options when a blended model is created. These blended models can address a wide variety of client needs in a variety of different ways. Some clients might be best suited with an all-in-one model while others could benefit from a combination of models that achieve the desired allocation.

Simplifying a Complex Landscape

The benefits of a blended approach are only nullified when overcomplication comes into play. Keep in mind that an overly customized approach could lead to inefficiency in the market and diminished returns. But when the models are blended tactfully and with a client’s unique circumstances in mind, advisors can potentially add measurable value to their expert advice.

Looking through models is simple in Kwanti’s Model Marketplace where our more than [#] model options are accessed. Our models are updated automatically as changes are made, ensuring you and your clients always have the most up-to-date numbers to work from.

If you are not yet a Kwanti user but are interested in seeing first-hand how our portfolio management services could benefit you, click here to start a free trial today. We are confident you’ll be pleased with what you find.